The complexities of high-net-worth divorces

The complexities of high-net-worth divorces

What is the purpose of the Employment Rights Bill?

When you suffer an injury due to someone else’s negligence, securing the compensation you deserve is crucial.

In recent family law, the issue of undisclosed assets in divorce proceedings has been under significant scrutiny, with courts...

The Supreme Court’s long-awaited decision in Hirachand v Hirachand has clarified some longstanding issues in Inheritance Act...

To extend the lease of a flat, a leaseholder has two options:

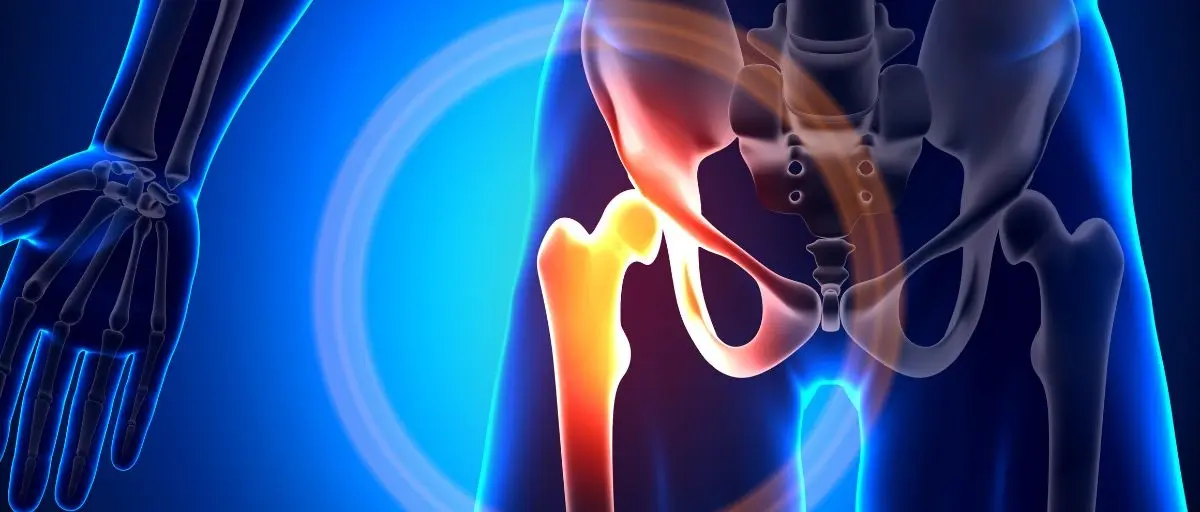

Causation is a fundamental legal principle in clinical negligence claims. It refers to the need to prove that the healthcare...

Will the new Rental Reforms Bill mean Landlords are given more freedom to identify good, trustworthy tenants?

The Sunday Telegraph reported on how retirement can significantly impact relationships, often leading to challenges - and even...

Domestic abuse, Christmas often intensifies existing relationship challenges, acting as a detonator for underlying tensions

The OIC process and how solicitors can assist claims that may be outside of the OIC portal.

We recently secured justice for a client who experienced significant suffering after a negligent hip replacement surgery.

At this time of year, you may not want to think about the future, when you may need someone to manage your affairs. But it’s an...

October 2024 laws changed regarding the way in which employers take reasonable steps to prevent sexual harassment and create a...

UK Capital Gains Tax is a tax on the profit (or ‘gain’) made when an individual or entity sells or disposes of an asset for more...

We’re here to help you get justice and get your life back on track after the physical, mental and financial hardships of a road...

Winter is deadly for cyclists, pedestrians, motorcyclists, e-scooter riders. There are more road accident claims after the clocks...

Learn about planned new employment rights: unfair dismissal, redundancy, fire-and-rehire, zero hours, flexible working, sick pay,...

Are you moving house? Buying your first home? Stamp Duty Land Tax is set to increase again on March 31 2025. Act now to beat the...

Disputing a will? Learn more here about the legal hurdles you must overcome. Get expert legal advice early to improve your chances...

The government has announced a New Fair Payment Code and promised stronger enforcement. But we doubt that will happen. Find out...

No amount of money can compensate for the loss of a loved one. But a fatal injury claim can bring justice, answers and much-needed...

Learn about the planned new ‘right to switch off’, along with 19 more new employment regulations being proposed by the government....

Planned new hardship tests would make it tougher for landlords to evict poorer tenants. Landlords could also be forced to improve...

Wills don’t cover pensions. So complete an expression of wish form to ensure your loved ones get the right payouts. Read more…

Whether you're a freeholder or leaseholder, let's discuss everything you need to know about Major Works Section 20 notices. Read...

Learn about child maintenance, financial disclosure, agreements, CMS enforcement if your ex-partner does not pay (or is hiding...

Protect your interests. Learn about your matrimonial property rights: family home, savings, investments, personal property and...

Learn the differences between consent orders and financial orders in divorce and dissolution of civil partnerships. Read more…

Dealing with debt during and after divorce requires careful management and a clear understanding of your legal responsibilities....

Learn about the different types of financial orders in divorce: lump sum, property adjustment, spousal maintenance, pension...

A separation agreement is a legal document establishing financial autonomy for both parties. But how can it ensure a stable...

Many financial questions can arise when a marriage ends, and one of the most frequent is regarding spousal support. Let's explore...

Divorce is a challenging transition, full of financial complexities. A key part of this process is negotiating a fair financial...

Financial conflicts during divorce can add significant stress. Let's explore how mediation can help you to navigate these disputes...

Ending a marriage is a major life change. Here are the key steps to consider when splitting your finances and planning for...

Ending a marriage is complex. This blog decodes common legal jargon to help you navigate your financial settlement confidently....

Understand your pension rights in divorce. Learn about the benefits and pitfalls of offsetting, pension sharing and pension...

Leaseholders will enjoy some very exciting and advantageous new rights under the new Leasehold and Freehold Reform Act 2024. Read...

Abolition of Section 21 ‘no fault’ evictions is going through Parliament. Learn what that means for you – and why you should act...