What the Autumn Budget means for residential leaseholders

-

What you need to know

How Coles Miller Can Help

Road traffic accidents are a daily reality on UK roads

What is the purpose of the Employment Rights Bill?

When you suffer an injury due to someone else’s negligence, securing the compensation you deserve is crucial.

In recent family law, the issue of undisclosed assets in divorce proceedings has been under significant scrutiny, with courts...

The Supreme Court’s long-awaited decision in Hirachand v Hirachand has clarified some longstanding issues in Inheritance Act...

To extend the lease of a flat, a leaseholder has two options:

Causation is a fundamental legal principle in clinical negligence claims. It refers to the need to prove that the healthcare...

Will the new Rental Reforms Bill mean Landlords are given more freedom to identify good, trustworthy tenants?

The Sunday Telegraph reported on how retirement can significantly impact relationships, often leading to challenges - and even...

Domestic abuse, Christmas often intensifies existing relationship challenges, acting as a detonator for underlying tensions

The OIC process and how solicitors can assist claims that may be outside of the OIC portal.

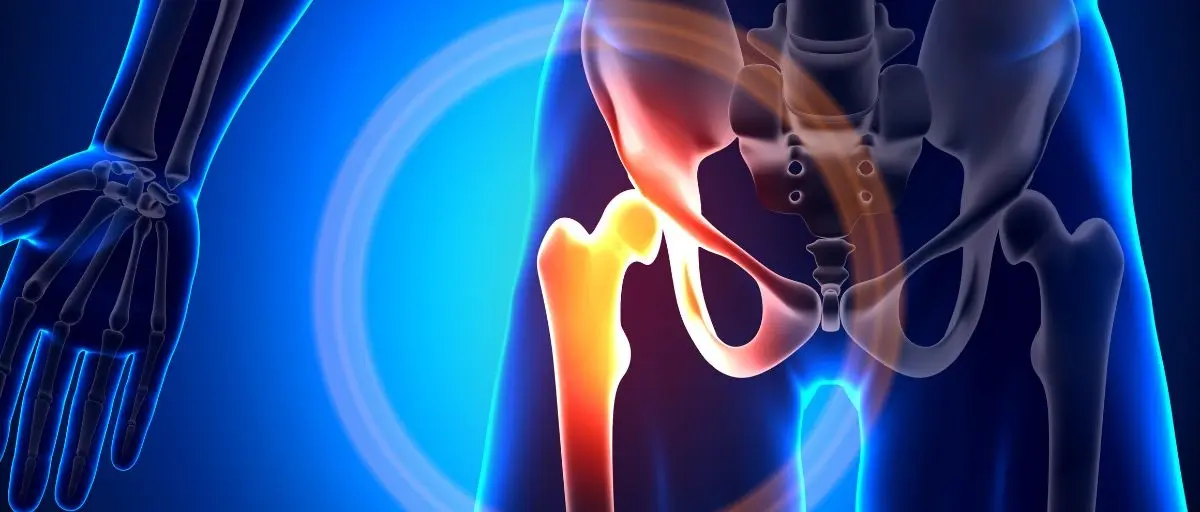

We recently secured justice for a client who experienced significant suffering after a negligent hip replacement surgery.

At this time of year, you may not want to think about the future, when you may need someone to manage your affairs. But it’s an...

October 2024 laws changed regarding the way in which employers take reasonable steps to prevent sexual harassment and create a...

UK Capital Gains Tax is a tax on the profit (or ‘gain’) made when an individual or entity sells or disposes of an asset for more...